When trying to find an auto insurance policy for your new car, shopping around for quotes can aid you obtain the best offer possible - low cost auto. Make sure to compare rates from at least three insurance companies utilizing comparable insurance coverage alternatives. For this action it aids to have a driver's certificate as well as established driving document; it is hard to obtain real vehicle insurance quotes without a license.

How much coverage you require depends on where you live, the automobile your plan to buy and your personal preferences. If you have an extra costly auto, you may want to think about purchasing additional coverage.

Frequently Asked Questions Concerning Getting Insurance Coverage Prior To Acquiring an Automobile, Getting auto insurance for a new vehicle can be challenging. Here are some responses to the most typically asked concerns related to insurance coverage for new vehicles to make the procedure less complicated - cheapest car insurance.

That stated, you don't have to have automobile insurance policy to evaluate drive a lorry. Can you acquire car insurance coverage on the same day?

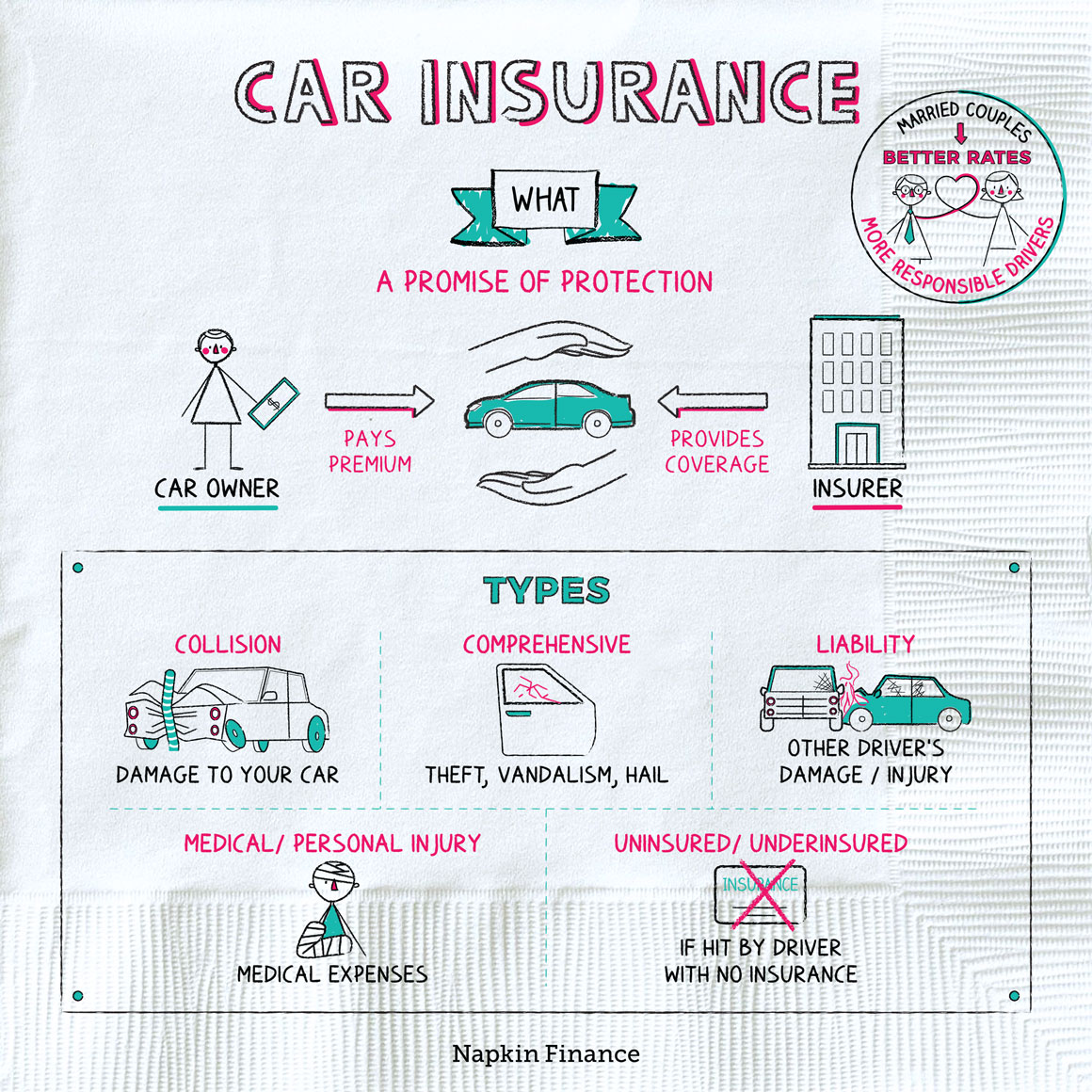

What is automobile insurance? Cars and truck insurance policy shields you monetarily if you get into an accident or if your car is harmed in other means.

Here's what you require to find out about insurance policy protection and also the process for accumulating on it. car. Fault varies by state The standard is that blame is designated for mishaps and also various other automotive incidents, with that resolution of fault affecting that pays the resulting expenses. Nonetheless, regarding a dozen states have what is recognized as no-fault insurance policy.

Indicators on Where To Buy Gap Insurance For Your Car - The Balance You Need To Know

car perks vehicle insurance car insured

car perks vehicle insurance car insured

The insurance provider then discusses with the various other motorist's insurance provider to get to contract on responsibility for the mishap (assuming it occurred in a state that appoints fault). That duty is split, your insurance policy company manages your claim and also its reimbursement, and works out up as required with the other chauffeur's insurance company to recoup some or all of your payment.

credit cars affordable auto insurance cheap auto insurance

credit cars affordable auto insurance cheap auto insurance

But you might have to pay an insurance deductible before you're made whole monetarily for the cost of damages you trigger to your own cars and truck. That cost is covered under the plan's collision and also extensive (C&C) insurance coverage, provided you lug that. You need to have adequate money to pay your C&C insurance deductible upfront.

If you live in a no-fault state, you're required to pay your very own insurance deductible in the event of an insurance claim, because no formal mistake is appointed-- as well as there is therefore no opportunity of the other vehicle driver in a mishap being held responsible for paying it. Advertisements by Cash - credit. We might be compensated if you click this advertisement.

Here are the actions to assist you select just how much insurance policy you must get. cheap insurance. Know the minimal responsibility you're needed to bring Regulators in your state stipulate the types and also quantities of responsibility insurance coverage you're called for by legislation to bring. Insurance providers will know these demands for your state.

The result: While sticking to your state's bare minimum of insurance policy protection could appear like a clever means to conserve cash, it can backfire by leaving on your own directly in charge of some of the price of injuries and home damage if you trigger a crash. Experts normally recommend insurance coverage of 100/300/100 - car insurance.

You likely don't require Med, Pay provided you and also others that ride with you have sufficient wellness insurance policy. However also those that are well-insured may consider getting optional PIP coverage because it would cover loss of revenue due to a crash, a minimum of to a monetary restriction. Lean in the direction of obtaining uninsured/underinsured driver coverage This safeguards you if you get involved in an accident with somebody who doesn't have or doesn't have enough insurance coverage of their very own.

Getting My Insurance Navy Names The Most Affordable ... - Pr Newswire To Work

Comprehensive covers every one of the negative things that can take place to your vehicle when you're not driving it: Theft, criminal damage, fire or tornado damage, and more. If your car is even more than one decade old, you could not need collision coverage anymore (auto). According to one of the most recent data available from the National Organization of Insurance Policy Commissioners, the typical insurance claim payout for crash problems is more than $4,000.

That stated, there are some reliable means to decrease your auto insurance policy premium. Search, consisting of on-line If you're browsing for auto insurance policy online, the majority of carriers have tools that allow you readjust your protection degrees if you're looking for a means to reduce your automobile insurance policy premium - money. To get cars and truck insurance coverage, you'll need a few items of information, including your driver's license number as well as the automobile identification number.

The costs you'll pay will certainly vary a great deal depending not just on the cost of the cars and truck you are getting, yet on various other factors regarding it, such as its incidence of insurance claims and prices to repair compared with other lorries. insurance. If you're purchasing a car from a dealer, you'll need to supply evidence of insurance before you can drive away with it.

Vehicle Insurance policy shields greater than your cars and truck. Secure on your own and your enjoyed ones with a cars and truck insurance coverage plan that fits your demands. Click listed below for a cost-free quote. Just how much does car insurance policy expense? The typical cost of automobile insurance policy in the united state is $1,732 a year, or roughly $144 a month.

dui insurance company automobile accident

dui insurance company automobile accident

car auto insurance company cheaper car

car auto insurance company cheaper car

Just how a lot you drive Broadly talking, the much more you drive, the greater your risk of an accident as well as the more you'll spend for automobile insurance coverage. Because many Americans invested many of 2020 working from residence as a result of the COVID-19 pandemic, huge insurance policy providers like Allstate, Geico, as well as State Ranch provided refunds to chauffeurs to reflect the reduction in miles driven. Customer watchdog teams, however, claim they need to have compensated motorists a lot more, as well as some states are buying firms to do simply that. Your driving document If you have web traffic tickets or at-fault accidents on your record, or much more significant violations like a D.U.I., you can anticipate to pay more to guarantee your vehicle.

Your credit rating Poor credit report is connected with a higher price of cases, so individuals with excellent or much better credit rating are more probable to be qualified for the very best prices. That plan attracts debate from some consumer supporters, and https://storage.googleapis.com also some insurance companies have actually vowed to do away with credit score ratings as a prices factor for vehicle insurance. cheapest auto insurance.

The Definitive Guide for Do You Need Auto Insurance Before You Buy Your Car?

Are you looking to buy vehicle insurance policy online? We understand that acquiring automobile insurance is a big decision, as well as we want to make sure it's a simple one as well.

By following our basic directions mentioned listed below, you can feel confident knowing that your brand-new plan will certainly be customized exactly just how YOU desire it. Purchasing cars and truck insurance online is an excellent choice if you wish to go shopping on your own routine and conserve time as well as money. The benefit of buying on-line auto insurance coverage is that you can quickly get quotes straight from insurers without calling business individually and also repetitively providing the very same information over the phone (cheapest auto insurance).

Most importantly, because you can get even more quotes quicker, you're bound to discover one of the most affordable plan and also conserve more money. Frequently shopping your policy is the very best method to choose financial savings. car insurance. As your life unfolds-- you have a birthday, you get a new auto-- insurer will typically transform the prices they charge, so your existing insurance provider may not stay one of the most budget-friendly over time.

Secret Highlights, To get exact vehicle insurance policy quotes, you need to offer a great deal of information concerning your auto and also other vehicle drivers in your house - automobile. After you share your information, the insurance coverage firm will certainly ask you to buy obligation insurance policy, which is called for in almost all states to legally drive a car.

When you have actually purchased your vehicle insurance coverage policy online, you can download and install an insurance card for insurance coverage evidence. Just how to get vehicle insurance policy online, We're here to aid. In this overview, we'll walk you through the actions of purchasing automobile insurance policy online, and answer some of one of the most typical questions individuals have concerning the process.

Make a note of the yearly and also month-to-month price of your insurance policy, because most of your quotes will be given both means. If you desire to get precise automobile insurance prices estimate from insurance companies, you will require to give a lot of details regarding yourself, your automobile as well as other vehicle drivers in your house. cars.

Some Of 6 Steps To Follow While Buying Car Insurance Online

In a lot of states, both play a vital duty in establishing your rates. Insurance provider most definitely review these documents, so stand up to any lure to be much less than truthful (insure). If you're not honest, the quotes you get will certainly be much various than what you will in fact end up paying. Action 2: Start Purchasing: Compare auto insurance policy quotes from different companies before you acquire, Currently that you have your individual info arranged, obtain a feeling of exactly how much car insurance coverage you ought to purchase, and what ordinary vehicle insurance rates are for your postal code for your age and preferred level of coverage, you're prepared to begin researching quotes from service providers.

Step 3: Pick Liability Limitations, After sharing details regarding you and your vehicle, you will certainly be asked to buy obligation insurance, which is required in almost all states to lawfully drive an auto. Physical injury obligation protection covers others' injuries if you create a crash. Property damages obligation insurance policy pays for damage to another vehicle or to other residential or commercial property caused by your automobile and also is additionally needed by the majority of states.

cheap insurance auto insurance cheapest car cheaper car

cheap insurance auto insurance cheapest car cheaper car

It's an instance of when the ideal vehicle insurance may not necessarily be the most inexpensive. You can buy added responsibility insurance coverage for about $70 a year, as well as get full coverage for concerning $1,180 per year, or $99 a month. The across the country ordinary price for state minimum liability coverage is $574Increasing that protection to $50,000/$100,000/$50,000 standards just $644.

If you opt for collision and thorough, you will have to choose an insurance deductible. The limitation is the maximum amount your insurance provider will certainly pay for problems and also the insurance deductible is the amount you pay out-of-pocket prior to your policy pays out.

It pays for the medical, recovery, funeral service, and also pain-and-suffering costs for you as well as for the travelers in your vehicle. Commonly it is a good idea to purchase this protection at the very same limits as your bodily-injury responsibility protection.